- ACTIVATE QUICK VIEW IN QUICKBOOKS FOR MAC INSTALL

- ACTIVATE QUICK VIEW IN QUICKBOOKS FOR MAC SOFTWARE

- ACTIVATE QUICK VIEW IN QUICKBOOKS FOR MAC PROFESSIONAL

Most students are instantly verified after completing the steps as outlined.

ACTIVATE QUICK VIEW IN QUICKBOOKS FOR MAC SOFTWARE

The trial software is available via the Intuit website using a service called SheerID.

ACTIVATE QUICK VIEW IN QUICKBOOKS FOR MAC INSTALL

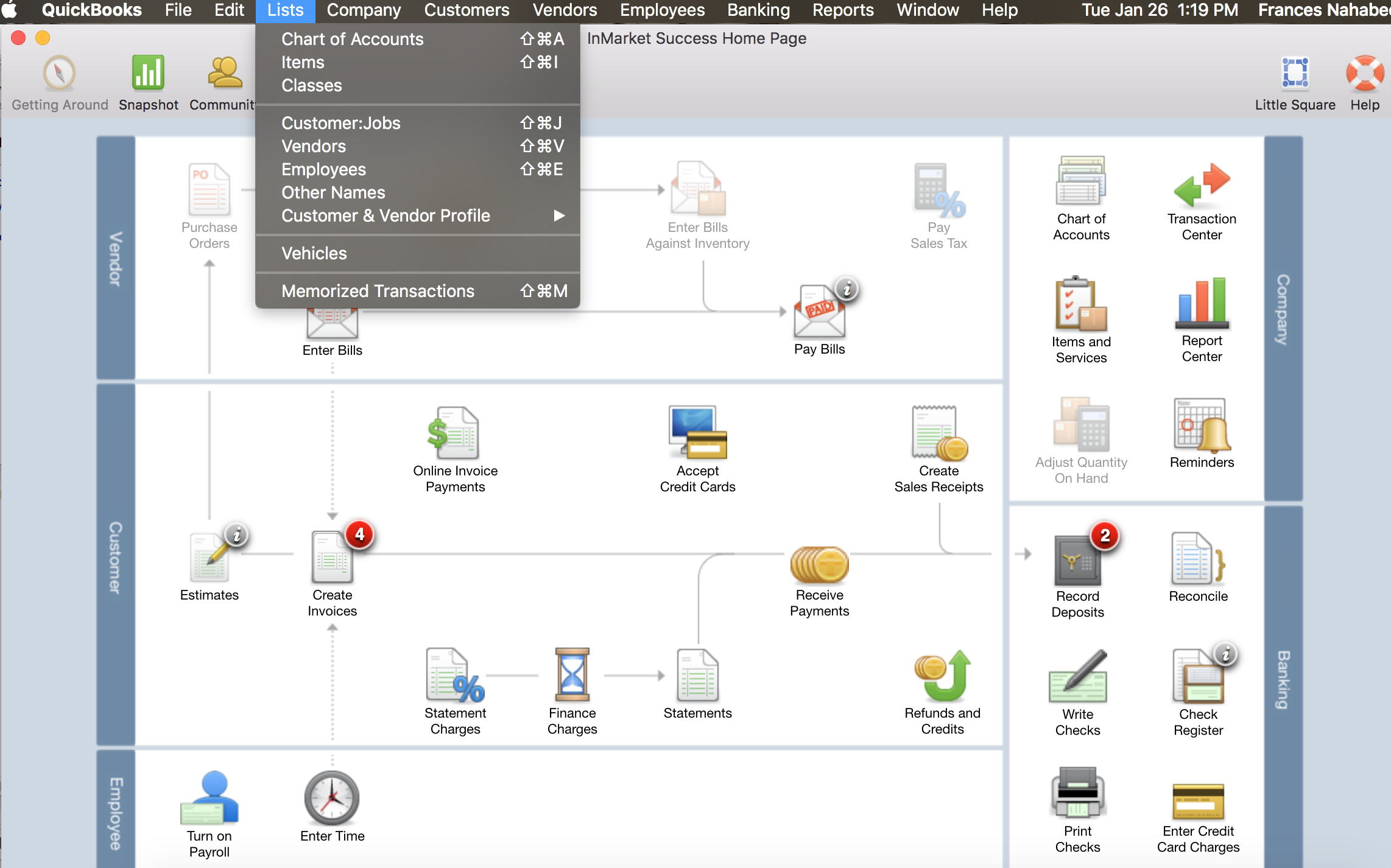

Install QuickBooks Desktop | Activate Your Trial | Toggle to the Pro Edition | Common Questions QUICKBOOKS ONLINE USERS: If you're taking a QuickBooks Online class, go here for instructions on setting up your Intuit QuickBooks Online account. Also included are instructions for toggling to the Pro edition of the software (necessary for some users), as well as a Common Questions section. We find that method to be easier to understand and maintain (since a balance sheet reports on segregated funds) for small non-profits with a limited number of balance sheet accounts that involve segregated funds.Included in this guide are instructions for installing the trial version of QuickBooks Desktop. When you reconcile the bank account, you’d reconcile the parent account. One sub account would represent the building fund and another the operating fund, and for this transaction, we’d do the transfer from the building fund sub-account. For a situation such as yours, we’d recommend having at least 2 sub-accounts on your 1 bank account (which would total to the 1 bank account). That’s something that was added to QB after class tracking was already established, but support for it is not as robust as for income/expense accounts. We’re not big fans of using class tracking on balance sheet accounts. If it’s not supported, then you’d be better off to void the transfer, and use a general journal entry, which does support classes. Why wouldn’t you simply put a class on the transfer? That’s supported in QB 2014, and it’s been a while since we’ve had to open QB 2011, so perhaps its not supported. Therefore, you’re best served by editing your current classes to match your needs as closely as possible and to use sub-classes to refine what you have if necessary. Beyond reporting in the middle of the year, changing classes will complicate reporting over several years, because the class used in an earlier year will now be inactive. If the classes are currently inactive, that means you’ll need to re-activate them to report on them. On the ramifications of changing classes in the middle of your FY, when you report on any program, you’ll have to be sure to select all of the classes that apply. If you’re going to have a lot of classes, make use of a structure so that you don’t make transaction entry overly complicated. We’d discourage an extensive active class list.įirst, you can rename or merge classes if the current names don’t fit, and that will only interrupt your current FY reporting if you merge classes, because you’ll lose the details of the separate classes.Ĭlasses are hierarchical in that you can have parent and child classes. To manage your classes, click on the Lists->Class List menu selection.

QuickBooks supports sub-classes, or nested classes, up to 5 levels deep. Since classes can be applied to both income and expense transactions, class tracking enables producing a Profit & Loss statement for each class.

ACTIVATE QUICK VIEW IN QUICKBOOKS FOR MAC PROFESSIONAL

0 kommentar(er)

0 kommentar(er)